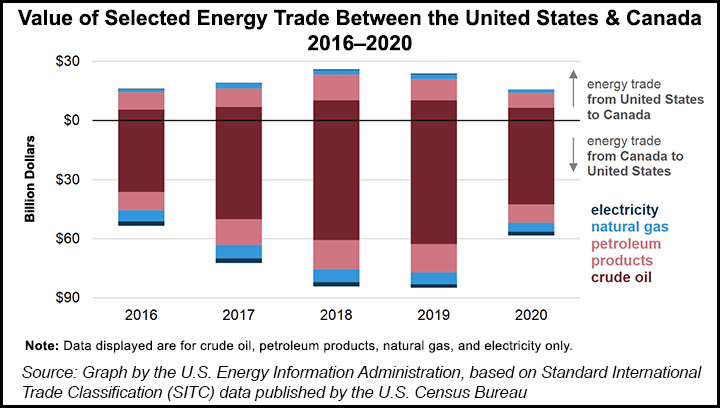

As Covid-19 depressed petroleum demand, the value of the energy trade between the United States and Canada fell sharply from 2019 to 2020, according to the U.S. Energy Information Administration (EIA).

Citing U.S. Census Bureau data, EIA said the value of domestic energy imports from Canada fell 31% in 2020 compared with the previous year. The statistical arm of the U.S. Department of Energy (DOE) also noted the value of U.S. energy exports to Canada was down 34% during the same period.

The total value of U.S. energy imports from Canada was $58 billion in 2020, equating to more than 20% of the value of all domestic imports from Canada, EIA said. Moreover, it noted that U.S. energy exports to Canada totaled $16 billion last year — the lowest level since 2016. Northbound energy exports included natural gas, crude, petroleum products and electricity.

EIA pointed out that 2019 was a record-setting year in terms of combined U.S. energy import and export volumes with Canada. U.S. oil imports from Canada averaged 3.8 million b/d in 2019 but dropped to 3.6 million b/d in 2020, the DOE unit noted.

“Although the total volume of U.S. crude oil imports from Canada fell in 2020, Canada’s share of total U.S. crude oil imports increased to 61%,” stated EIA.

One project that would help Canada to boost its oil export options beyond the United States is the C$12.6 billion ($10 billion) Trans Mountain Pipeline Expansion.

Shrinking OPEC Role

EIA attributed the higher prevalence of Canadian crudes in the United States year/year to declining domestic imports from the Organization of the Petroleum Exporting Countries (OPEC). Specifically, EIA said crude imports from Canada replaced those from OPEC member Venezuela during the period. OPEC and allied major oil producers led by Russia, collectively known as OPEC-plus, recently agreed to continue raising output.

Underscoring the U.S.-Canada energy trade relationship, EIA said crude and petroleum products together made up 89% of the value of all imports from Canada in 2020. Because overall U.S. energy imports were down in 2020, however, EIA noted that southbound energy movements were at a four-year low. The DOE unit said the pandemic-related drop in petroleum consumption drove the decrease.

EIA said average U.S. crude exports to Canada — typically low-density and low-sulfur crudes destined for Eastern Canada — dropped from 479,000 b/d in 2019 to 420,000 b/d in 2020. It added that high-sulfur crudes from Western Canada’s oilsands, bound for refineries in the U.S. Midwest, make up the bulk of southbound flows.

Oil and product flows between the United States and Western Canada have been constrained recently amid flooding in British Columbia.

“Petroleum product trade between the United States and Canada is relatively balanced in both volume and trade,” EIA stated.

The DOE unit said the United States imported 529,000 b/d of petroleum products from Canada in 2020, down year/year from a high of 618,000 b/d. In addition, the value of petroleum product imports from Canada to the United States dropped 36%, to $9.2 billion, during the period. Declining 30% year/year was the value of U.S. petroleum product exports to Canada, which amounted to $7.6 billion in 2020, EIA noted.