(Pixbay)

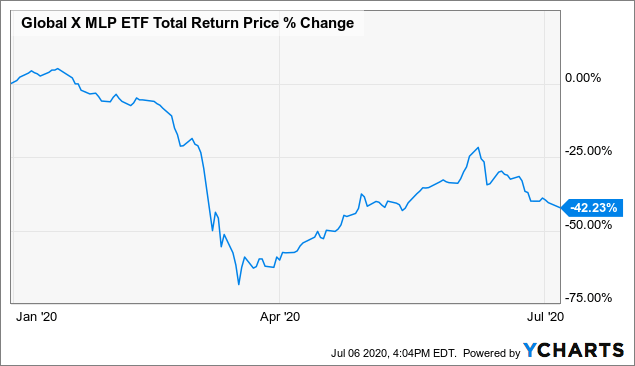

Just as midstream MLPs were finally reaching a point of stability, COVID-19 swept in and decimated the U.S rig count, causing many midstream MLPs to lose over half of their value. ETFs like the Global X MLP (MLPA) saw a net decline around 60% and it still down over 40% YTD:

Data by YCharts

Data by YCharts

MLPA invests primarily in energy pipelines and storage facilities across the U.S. which are highly sensitive to energy consumption and production. When a lot of energy is being produced and consumed, volumes are high and MLPs generate significant profits. Unfortunately, the market has been in a glut for years that recently hit an extreme due to the substantial decline in commuting and air travel. This has resulted in a drastic decline in midstream revenues.

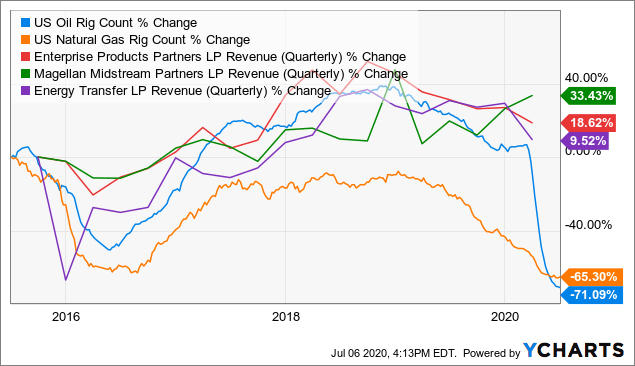

As you can see below, the quarterly revenues of the top three firms in MLPA Enterprise Products Partners (EPD), Magellan Midstream Partners (MMP), and Energy Transfer (ET) are closely correlated to the U.S oil & gas rig count:

Data by YCharts

Data by YCharts

As you can see, just as the rig count was stabilizing in early 2020, it utterly collapsed. This has led to a substantial decrease in U.S. field production and far lower demand for the transfer of energy, thereby decreasing MLP revenues.

Looking closer, we can see that the rig count is no longer in decline which means that the worst is likely behind many of these MLPs. MLPA's price had recovered about half of its losses but has since turned back lower. In my opinion, this has created a solid buying opportunity for the fund. Let's take a closer look.

Assessing the Turmoil in Midstream

Inevitably, the U.S. rig count will almost certainly return to pre-COVID-19 levels as the consumption of fossil fuels is unlikely to decline materially anytime soon. Production has collapsed and I believe COVID-19's impact on energy producers' financial wherewithal will result in an end to energy production growth which has been a major economic force over the past decade. Ideally, this will lead to lasting stability in the energy sector which has been extremely unstable for years.

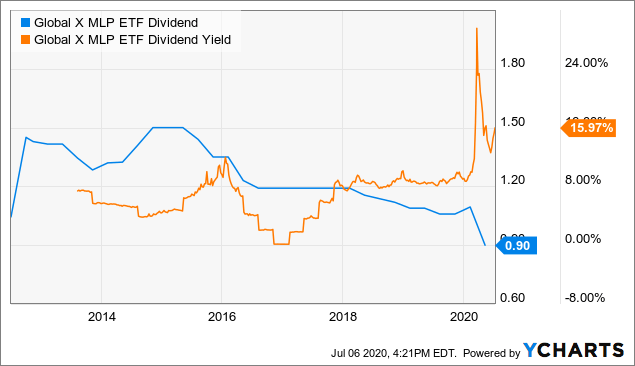

The COVID-19 related oil-turmoil has caused many firms in MLPA to substantially reduce dividends in order to save cash. This has caused MLPA's dividend to decline nearly 20%, though its dividend yield is still at an extremely high 16%:

Data by YCharts

Data by YCharts

With such a high dividend yield and signs of stability in the energy market, many investors are likely looking to buy MLPA while it's this cheap. This is likely a good trade if and only the firms in MLPA do not go the way of Chesapeake (OTCPK:CHKAQ) and survive the crisis.

On that note, the collapse of Chesapeake is an important story for midstream investors to consider. Chesapeake (and other nearly bankrupt producers) are major customers for these MLPs and many are looking to modify contract terms in court. This is a risk to MLPA as it would result in midstream firms losing more revenue than expected, possibly causing many to be forced into bankruptcy.

Luckily, the Chesapeake case currently suggests Federal authorities are unlikely to allow bankrupt producers to modify contracts to the expense of midstream pipelines. If so, MLPA has a low counterparty risk with the most significant risk being MLPs' balance sheet leverage and financial covenants.

A Closer Look at Midstream Firms' Financial Health

In general, midstream MLPs are more stable than their energy-producing customers. They are rarely directly subject to the price of crude or natural gas and are mostly subject to changes in production and consumption volumes (which are indirectly tied to energy prices).

Today, crude oil and (very recently) natural gas prices are seemingly back on the rise which means volumes will likely rise back to normal over the coming months. As long as the midstream MLPs have sufficient cash to get through the next few months, they will likely see full cash flow recoveries.

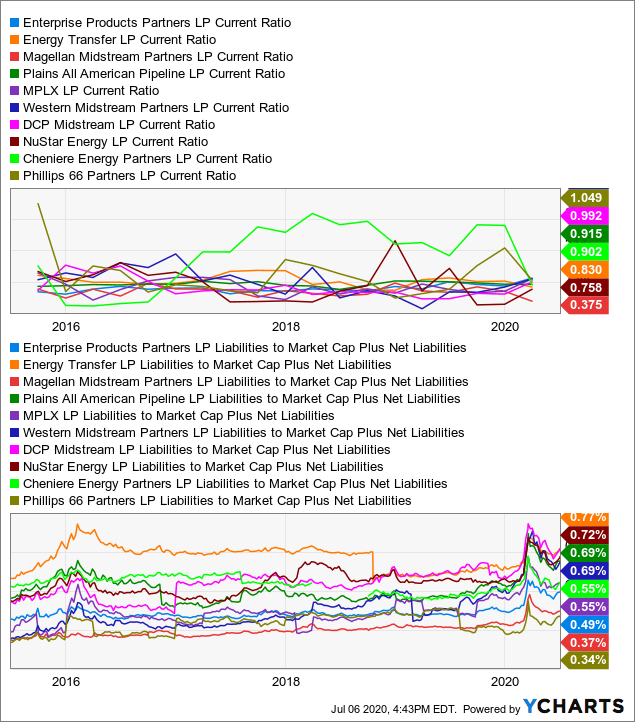

Unfortunately, many of these firms are also in a tough financial situation. Most only have enough liquid assets on hand to meet current liabilities as seen by the top ten firms in MLPA having a median current ratio of about 0.9X. Additionally, most have high debt obligations with those firms having median net liabilities to market cap plus net liabilities (a proxy for asset value) of 70%:

Data by YCharts

Data by YCharts

This indicates that many of the firms in MLPA are at bankruptcy risk if the current period of negative EBITDA is prolonged. I believe this is generally unlikely, but if these firms are forced to refinance their debt at today's rates for energy firms (often over 10%), many will be paying most of their would-be dividends to debt investors.

Despite the higher balance sheet risks these firms carry, I believe they will make it through this period without needing to restructure. Volumes have been low this quarter, but they are recovering and will likely rebound eventually. Since COVID-19 continues to be an issue, it is unlikely they will fully recover until Q4 or later, but it will come nonetheless. Still, I would not be surprised if MLPA sees another dividend cut as many of its holdings reduce dividends in order to reduce leverage.

Looking Forward

Given the evidence, I believe that the U.S. energy market is finally reaching a point of stability. The rig count has reached an extreme low that is causing the energy glut to become an energy shortage. While stocks as a whole are still frothy, bad news surrounding midstream MLPs is at a peak but is unlikely to worsen.

Of course, there are a few other risks to consider that may impact its short-run performance. A U.S. District Court Judge recently ordered the shutdown of the Dakota Access Pipeline owned by Energy Transfer and Phillips 66 Partners (PSXP) over ongoing concerns regarding environmental pollution in the Missouri River. This sent those two MLPs lower by double digits and has stoked fears regarding further regulation of the pipeline industry.

That said, it is unclear if the order will stand. Put simply, for people to turn on their lights or appliances, they'll need a pipeline (or similar) to transport that energy. Thus, regardless of the order's validity, lower volumes in one pipe will likely bring higher volumes in others. Regulation and shutdown orders are a risk, but other risks are far more substantial today when looking at the industry as a whole.

With valuation low and many investors racing for the exit, I believe a long-term value opportunity exists in MLPA. While I believe its dividend may see another cut, it will still likely have a double-digit yield for today's investors which is unheard of essentially everywhere else in today's market. I am a long-term bull on MLPA and prefer it to its peer ALPS Alerian MLP ETF (AMLP) due to its lower expense ratio of 43 bps.

Interested In More Long-Term Investment Ideas?

If you're looking for (much) more research, I run the Core-Satellite Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios as well as weekly commodity and economic research reports. Additionally, we provide actionable investment and trade ideas designed to give you an edge on the crowd.

As an added benefit, we're allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they'd like. You can learn about what we can do for you here.

Disclosure:I/we have no positions in any stocks mentioned, but may initiate a long position in PSXP, MPLA over the next 72 hours.I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.