Bloom Energy power storage equipment, San Ramon, California, September 18, 2020. (Photo by Smith ... [+] Collection/Gado/Getty Images)

The stocks of hydrogen and fuel cell makers fared well last year, driven by increasing interest in clean energy, the recent extension of tax credits for fuel cell projects, and the election of Democrat Joe Biden to the U.S. presidency – who has proposed to spend as much as $2 trillion on fighting climate change. Bloom Energy and FuelCell Energy (NASDAQ: FCEL), two well-known names in the fuel cell market, saw their stock prices soar by 3.5x and 5x, respectively, over 2020. Let’s take a look at the two companies a little more closely to find out which could be the better pick for investors. See our analysis Bloom Energy vs. FuelCell Energy: BE stock looks very undervalued compared to FCEL stock for more details on how the financial and valuation metrics for the two companies compare.

Bloom Energy sells solid oxide fuel cell generators called Bloom Energy Servers

Bloom’s Revenues have expanded from around $366 million in 2017 to about $758 million over the last 12 months, driven by growing installations of its servers. For instance, with power outages and wildfires in recent years in California, companies started to work with Bloom’s products. FuelCell

Now let’s look at the relative valuation of the two companies. FuelCell Energy trades at a much higher price to sales multiple of 40x, compared to about 5x for Bloom. This doesn’t make sense, considering that both companies operating in the same industry with Bloom apparently working with superior technology. Moreover, Bloom has more than doubled its Revenue since 2017, while FuelCell has seen sales decline by about one-third over the same period. Considering this, we think that Bloom Energy is currently the better pick of the two stocks.

[12/11/2020] Stocks To Play The Hydrogen Economy

Interest in clean energy stocks has soared this year, driven by low-interest rates, improving economics, and the election of Democrat Joe Biden – who has proposed to spend as much as $2 trillion on fighting climate change – to the U.S. presidency. While solar and electric vehicle stocks have been the most high profile winners, another theme that appears to have caught investors’ interest is the concept of the “hydrogen economy” or the use of hydrogen as a fuel for transportation and other energy requirements, replacing fossil fuels.

Hydrogen burns much cleaner than petroleum-based fuels and can be produced using just water and energy or from hydrogen-rich gases such as methane. Hydrogen is also seen as a means of storing excess renewable electricity – as the electricity can be used to run a process of electrolysis, which converts water into hydrogen. Our theme of Hydrogen Economy Stocks includes the stocks of U.S. based companies that sell fuel cells, renewable energy equipment, and supply hydrogen gas. Below is a bit more about the companies in our theme and how they fit into the broader picture of the Hydrogen Economy.

Bloom Energy sells solid oxide fuel cell generators called Bloom Energy Servers that use natural gas or biogas as fuel via an electrochemical process without combustion. The company also develops hydrogen fuel cells – that use only hydrogen gas as fuel. The stock is up 245% year-to-date.

FuelCell Energy (NASDAQ: FCEL) is a company that designs and manufactures carbonate and solid oxide fuel cells that run on hydrogen-rich fuels such as natural gas and biogas. The company also operates over 50 fuel cell power plants across the world. The stock is up 229% year-to-date.

Air Products and Chemicals

First Solar

Cummins (NYSE: CMI) – an industrials company best known for its engines and power generation products – has been working on hydrogen-based technologies for almost two decades. The company acquired Hydrogenics, a leading Canadian hydrogen fuel cell player last year. The stock is up 23% year-to-date.

Trefis

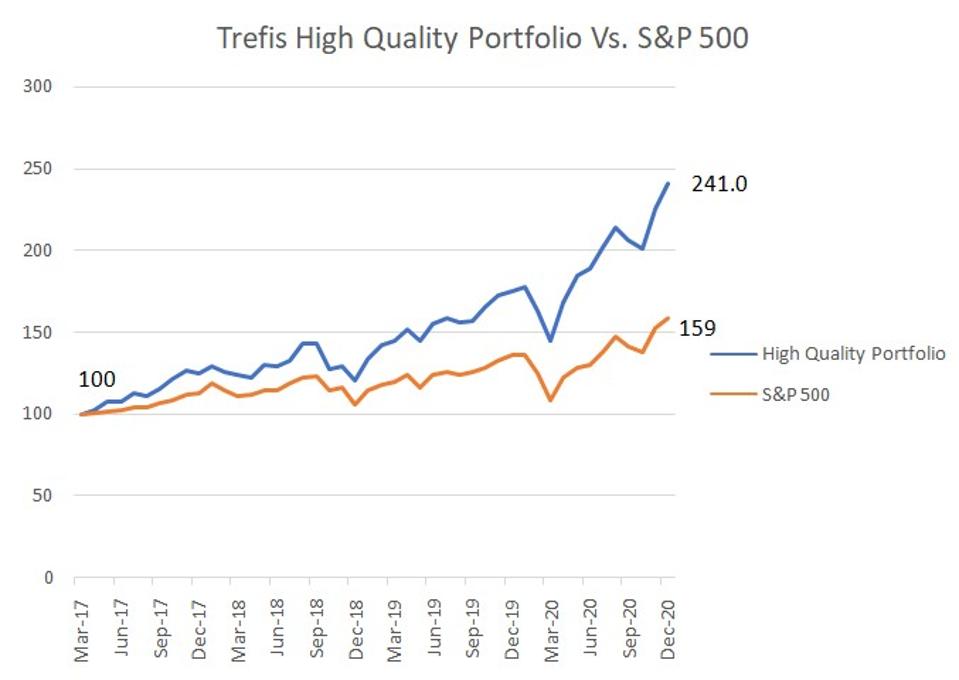

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio to beat the market, with over 130% return since 2016, versus about 65% for the S&P 500. Comprising companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams