Houston — Mexico Pacific Limited is in advanced discussions with customers in South Korea, Japan and China about purchasing supplies from the up to 12.9 million mt/year liquefaction terminal it is proposing to build on Mexico's West Coast, CEO Douglas Shanda said Jan. 28.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience.

Register NowThe stepped-up talks follow a run-up in Asian spot prices and extended wait times that have persisted since October at the Panama Canal for LNG tankers passing through without a reservation.

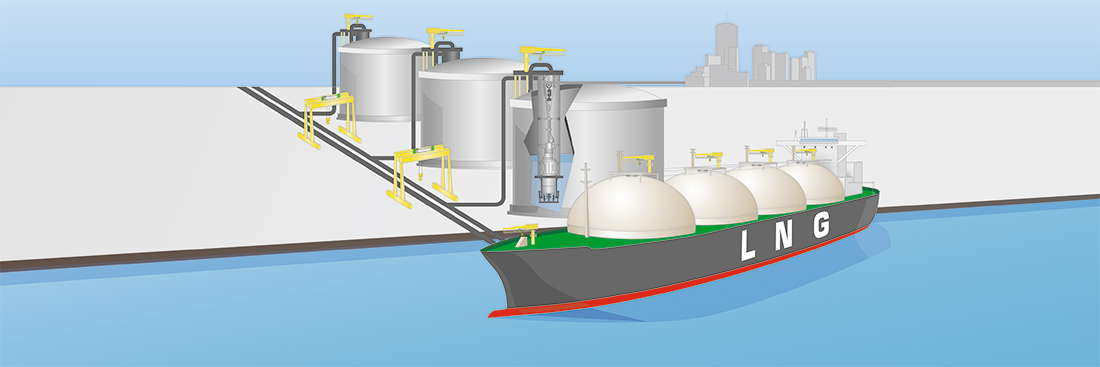

Perhaps the project's biggest draw has been its proposed location on the Pacific Ocean. Tankers would be able to avoid the Panama Canal and reach East Asia, MPL's primary customer target, in about half the time it takes for shipments from the US Gulf Coast. Months of constraints at the Canal have put greater focus on the location advantage.

"The delays in the Panama Canal, and to a large part the weather in the Gulf of Mexico, didn't necessarily increase the level of engagement, but what we have seen is a level of urgency around getting something done," Shanda said in an interview with S&P Global Platts. "There is more of an urgency on their side to moving things forward to binding offtake."

The only new North American liquefaction project to be sanctioned in 2020 was Sempra Energy's Energia Costa Azul export facility, which also is being built along Mexico's Pacific Coast.

MPL, which is catering mostly to utilities and other end-users, has preliminary agreements with five Asian counterparties covering 10 million mt/year of supply. Shanda would not name the counterparties, but he said the three biggest importing countries in the region – South Korea, Japan and China -- are represented.

MPL is on track to start closing binding agreements around the middle of this year – when it also expects to receive an export permit from the Mexican government -- and reach a final investment decision on the first and second phase of the project by the end of 2021 or in early 2022, Shanda said. A lump-sum turnkey agreement with a contractor to build the facility is still being pursued. Shanda expects the cost of the facility to be in line with second wave Gulf Coast terminals that have promised a cost of $500-$600/mt.

"For us to be competitive, we have to be in that neighborhood," Shanda said.

TechnipFMC is doing the front-end engineering and, along with Bechtel, is in the mix for discussions about the engineering, procurement and construction contract, he said.

Backed by venture capital firm Avaio Capital, the facility would be built at a site of what was supposed to be an import terminal.

MPL is looking to index its contracts to the US Henry Hub or Waha, and it is open to agreements under which the offtaker would procure its own feedgas or MPL would procure the gas for the offtaker.

Contract length

At full capacity, MPL would push Northwest Mexico gas demand to 2.4 Bcf/d, or double the inflow capacity to the region. Considering that the El Paso Natural Gas pipeline could be affected by both ECA and MPL's LNG export projects, various expansion opportunities will likely occur, if MPL reaches FID like ECA did in November.

One thing Shanda is holding firm on is contract term. The memorandums of understanding that MPL has signed contemplate traditional 20-year agreements.

"Three or four years ago, when I was at my previous job, everybody kept saying the long-term deal was dead," the former Cheniere Energy executive said. "Then we signed six or seven long-term deals. I find everybody talks about shorter term deals, but that's not what we are hearing from our customers."

Shanda added: "There's no magic about it. It's price and term."