Summary

- Southern Africa is facing an energy crisis with rising shortages of electricity hampering industrial and investment growth.

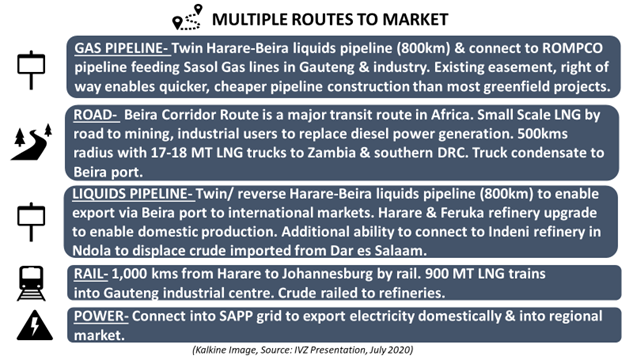

- However, there are multiple markets, monetisation options and routes to market in the region.

- Invictus Energy is an upstream exploration and production company focused on oil and gas in Sub Saharan Africa.

- The Company is 80% owner and operator of the Cabora Bassa Project containing EL SG 4571.

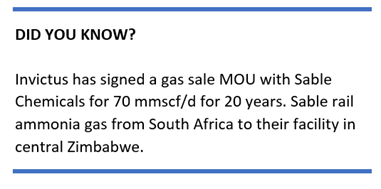

- Invictus intends to develop potential regional markets and cater to the considerable local natural gas demand in Zimbabwe.

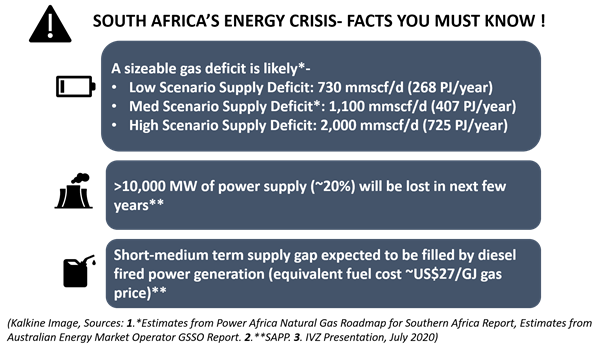

Research reports suggest that South Africa may confront a major gas deficit before 2030, owing to the lack of supply. Driven by an escalating energy crisis, the transition from gas to power has become increasingly important to the regional power needs.

Upstream E&P company, Invictus Energy Limited (ASX:IVZ) has identified a giant scale potential within EL SG 4571 in Cabora Bassa. Various play types offer running room on success.

The Company seems to be strategically positioned to supply energy-starved domestic and regional markets – particularly the large South Africa market. Besides, lucrative market opportunity and supportive government are added advantages.

IVZ shares traded at $ 0.061 on 22 September 2020. The share price increased ~7x over the past 6-months.

GOOD READ: Lens Through Invictus Energy’s Robust June 2020 Quarterly Activities Report

South Africa’s Energy Crisis

Industrial users have been warning that South Africa is approaching a gas supply cliff edge. Consequently, this southernmost country in Africa is urgently seeking gas as energy transition stalls. The region seeks to shift its power sector from heavily polluting coal to the cleaner alternative of renewable energy, supported by gas.

Introducing Southern African Power Pool (SAPP)

Before an overview of the market opportunity in South Africa, it is important to acquaint with Southern African Power Pool (SAPP)-

- SAPP was established in 1993.

- It enables cross-border electricity trading between states in South Africa.

- Through SAPP, 12 member countries represent a population of 230 million people.

- The backbone of the SAPP transmission network runs through Zimbabwe, giving it the best access to other member states.

- SAP network provides a virtual pipeline route to monetise gas within and across borders through Gas to Power projects.

Major Markets & Various Monetisation Options In South Africa

There are multiple markets and monetisation options in South Africa. Some of these are- Angola, Namibia, Botswana, Mozambique, Malawi, Zambia, DRC and Tanzania.

Let us now cast an eye on various monetisation options-

- Gas to Power can be domestically generated. Excess can be exported to neighbouring countries via the SAPP. There is huge electricity shortfall in the region with >15,000 MW of new generation capacity required.

- Petrochemical demand exists via Sasol’s Secunda facility. This is supplied from (onshore) Mozambique Pande-Temane fields as well as coal to liquid technology.

- Zimbabwe and Zambia are agriculture-based economies. They are significant producers of tobacco and maize. Majority of the fertiliser is imported from South Africa.

- Industrial demand is mostly serviced from (onshore) Mozambique. Top 10 industrial gas users in South Africa contribute more than ZAR150 billion per annum in turnover, consume >30 Bcf/yr and employ 46,000 people.

- Many mining houses (esp. Zambia & DRC) produce off grid power via diesel at ~30-40c/kWh vs. grid cost of 10-15c/kWh. Small scale LNG trucked to mining operations can displace diesel at ~40% of the cost. Besides, large smelters and refiners in Zimbabwe, Zambia and South Africa can shift to natural gas.

- Liquid fuel consumption is ~880kbpd. South Africa produces synthetic fuel from coal of ~180kbopd. The balance comprises of imports of crude oil, refined domestically along with refined products. Condensate/crude can also be exported from Beira to global markets.

GOOD READ: Lens Through Invictus Energy’s Gas Market Opportunity in Zimbabwe- Africa’s Lucrative Rift Basin

Monetisation Routes In South Africa

Seemingly, the low-cost onshore exploration with proximity to infrastructure enables rapid monetisation of discoveries and mitigates risk vs. reward. This enhances Invictus’ first mover advantage in Zimbabwe.

For an overview of the Company’s latest developments, READ HERE- How Are Developments Fostering at Invictus Energy After A Successful June Quarter?